Elevate your local knowledge

Sign up for the iNFOnews newsletter today!

OTTAWA — As Prime Minister Mark Carney’s government moves to spend billions more on tax credits to support carbon-capture and storage projects, Canada’s environment commissioner says the money already earmarked has not been spent effectively.

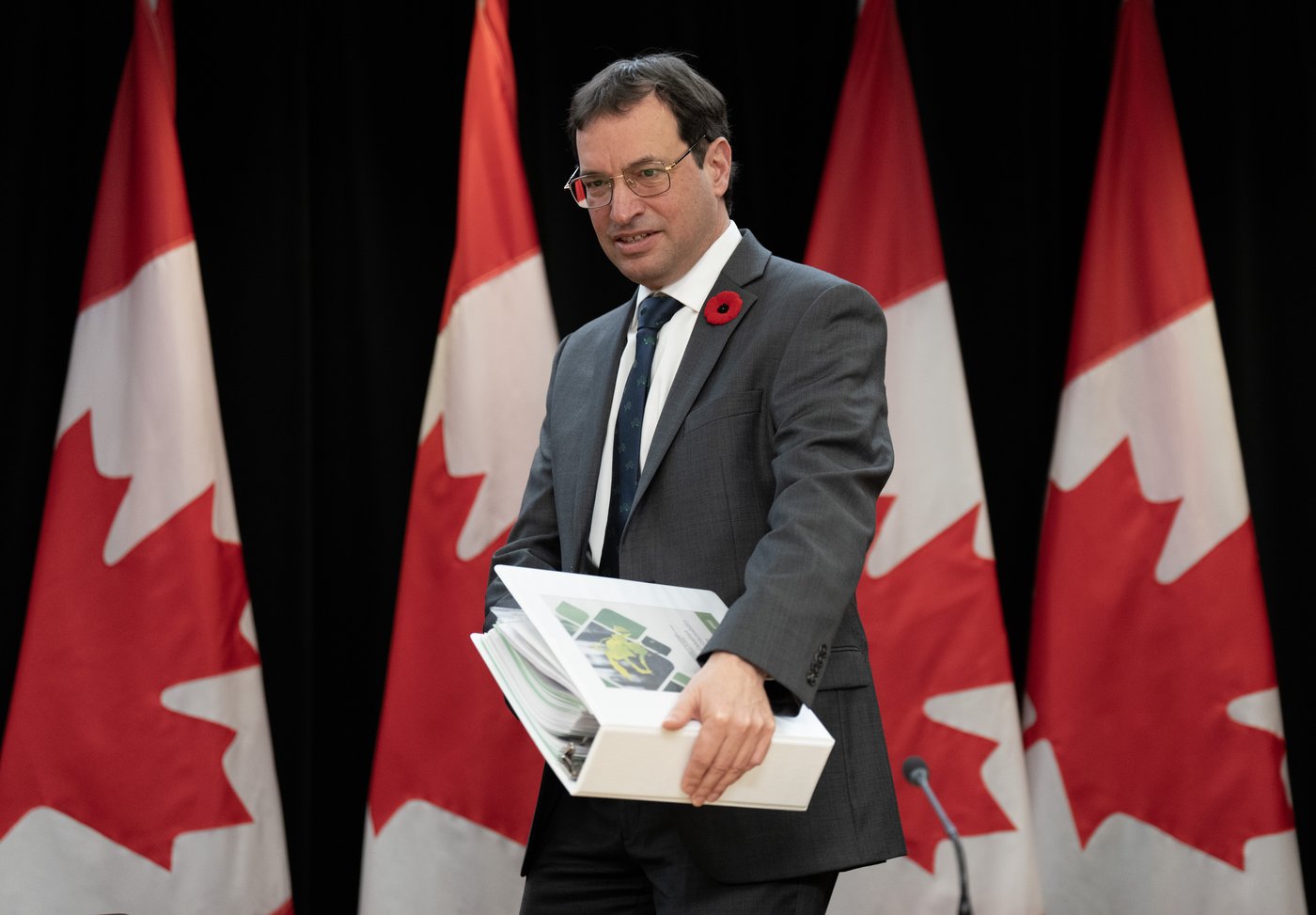

A new audit report released Thursday by Jerry DeMarco said government investments in projects to reduce emissions, including carbon capture and storage, have been implemented poorly, with far less uptake than predicted.

The report looked at nine measures from Canada’s 2030 Emissions Reductions Plan. Five were investment tax credits and one was a corporate tax break for zero-emission technology manufacturers. The others include the Canada Growth Fund and green bonds.

Collectively, they account for $123 billion in projected costs to taxpayers. The federal budget released Tuesday proposes expanding the availability of the carbon capture investment tax credit, projected to cost another $3 billion between 2031 and 2035.

DeMarco said there’s no data to show the impact those investments have had on lowering Canada’s emissions.

“It’s disappointing to see that there isn’t a strong emphasis by the government on estimating the expecting emissions from each tax credit, and as well estimating the value for money for Canadians in these large-scale subsidies,” DeMarco told The Canadian Press.

“We don’t have adequate information from the departments as to the actual expected emissions from each measure. And that’s a theme, not only today, but also our previous audits on the net-zero accelerator (fund) and the emissions reduction plan — two other significant subsidies.”

DeMarco’s report says there was low initial uptake of the tax measures, compared to Finance Canada’s projections.

“For example, fewer than 30 corporations had claimed the corporate tax cut for manufacturers and producers of zero‑emission technologies since 2022, which was 25 per cent of the projected uptake of $61 million,” the report says.

“For the five Clean Economy investment tax credits that we assessed, the Department of Finance Canada had initially projected that $5.2 billion would be claimed by the end of March 2025. The department’s most recent projections, published in March 2025, forecasted that $9.2 billion is expected to be claimed by the end of 2025.

“However, we found that, as of July 2025, only the Clean Technology Investment Tax Credit had claims to be paid out, and those claims totalled only $22 million.”

The report did say taxpayers can still submit claims for carbon capture and storage credits until the end of the year for the previous three years — so the uptake numbers could change.

“They’re not even pretending to want to meet the 2030 climate target in Ottawa anymore,” said Patrick Bonin, the Bloc Québécois’s climate critic.

“The Liberals prefer wilful blindness, shining the spotlight on 2050 to sweep the dust under the rug. The government must pull itself together and realize that the climate emergency remains.”

DeMarco’s report also says government investment incentives for the oil and gas sector were risky, given the uncertain future of Ottawa’s industrial carbon pricing plan.

“To be effective, investment incentives in both carbon capture, utilization, and storage and low-carbon hydrogen depend on other important climate change policies, such as the industrial carbon pricing system and the Clean Fuel Regulations,” the report says.

“As such, uncertainty in the future of the industrial carbon pricing systems and federal regulations creates risk to the financial viability of private investment in those technologies.”

The federal budget did promise to strengthen Ottawa’s industrial carbon pricing system but offered no details on how the government plans to do that.

DeMarco’s report also says that of the $2.7 billion already committed from the Canada Growth Fund — which is meant to support technologies like carbon capture and storage and low-carbon hydrogen — $1.7 billion was allocated to only two projects in the oil and gas sector.

DeMarco notes that those two projects could double-dip by accessing the Canada Growth Fund while also earning investment tax credits without reducing the amount of emissions they claimed. DeMarco said it was impossible to say whether that was actually happening.

“This is the only Clean Economy investment tax credit where applicants are not required to reduce their amount claimed when combining with other federal assistance,” the report says.

“We found that the two projects funded by the Canada Growth Fund planned to also claim the investment tax credit, resulting in the federal government covering most of the capital cost of these projects.”

DeMarco also called out the government for not publishing a complete list of its fossil fuel subsidies, which had been expected by December 2024, and for not completing the peer-review study it announced in 2018.

As The Canadian Press reported in June, Canada’s progress on the study stalled in 2023 after its partner country Argentina ceased participation, following the election of right-wing a populist leader who has referred to climate change as “a socialist lie.”

“A peer review would increase the transparency of the government’s assessment of financial measures directed at the oil and gas sector,” DeMarco’s report said.

This report by The Canadian Press was first published Nov. 6, 2025.

Want to share your thoughts, add context, or connect with others in your community?

You must be logged in to post a comment.